13th October 2022

In this week's TWO15, we discuss 5 pricing tactics that could help you increase your sales.

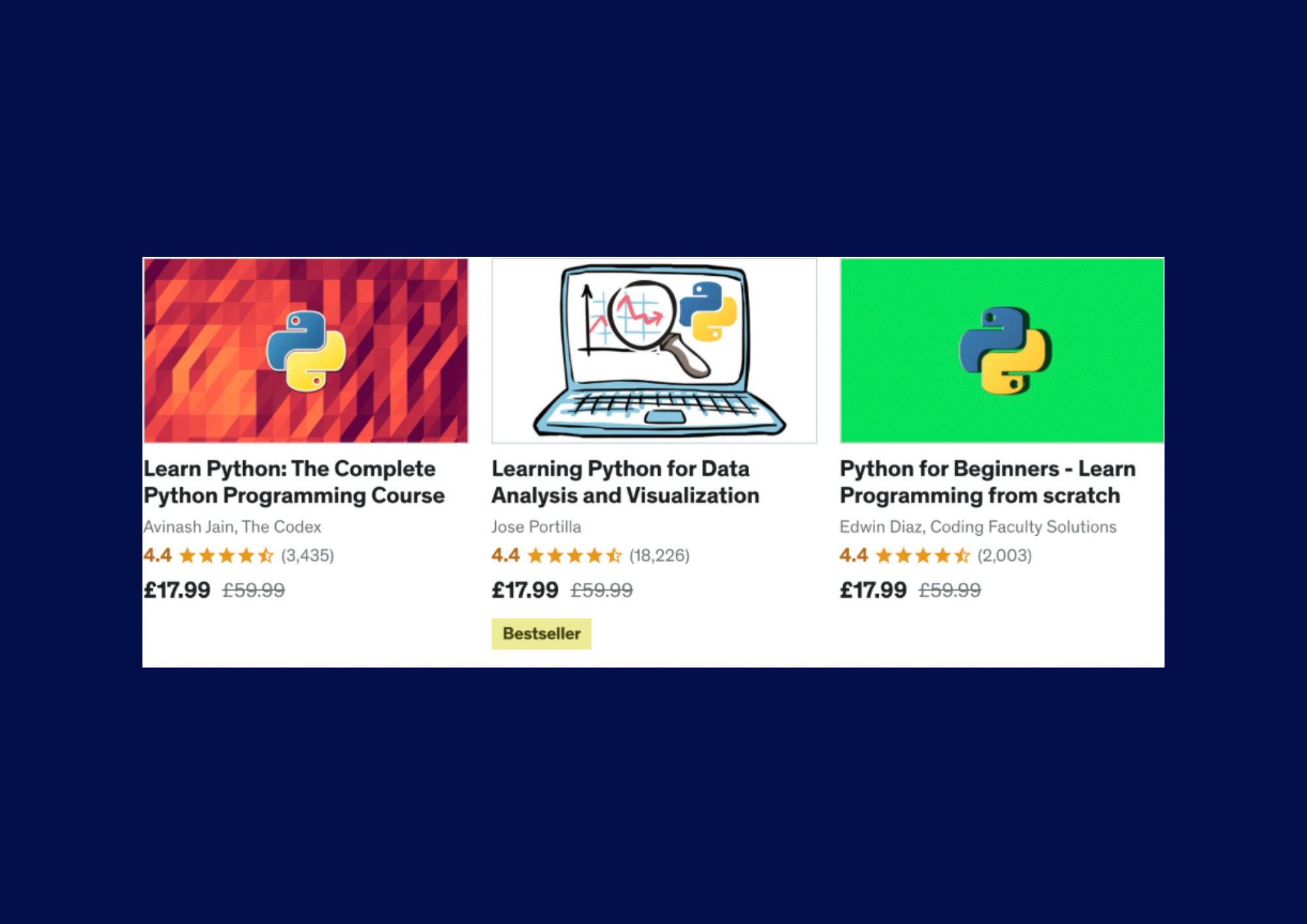

Firstly, anchoring.

What is it? Price anchoring refers to the first piece of information you see. Using that as a point of reference, it can encourage customers to make a decision. In the image below you can see the discounted amount and then next to it, is the original price. Providing discounts and keeping the original price next to the deal, helps create value and can increase sales.

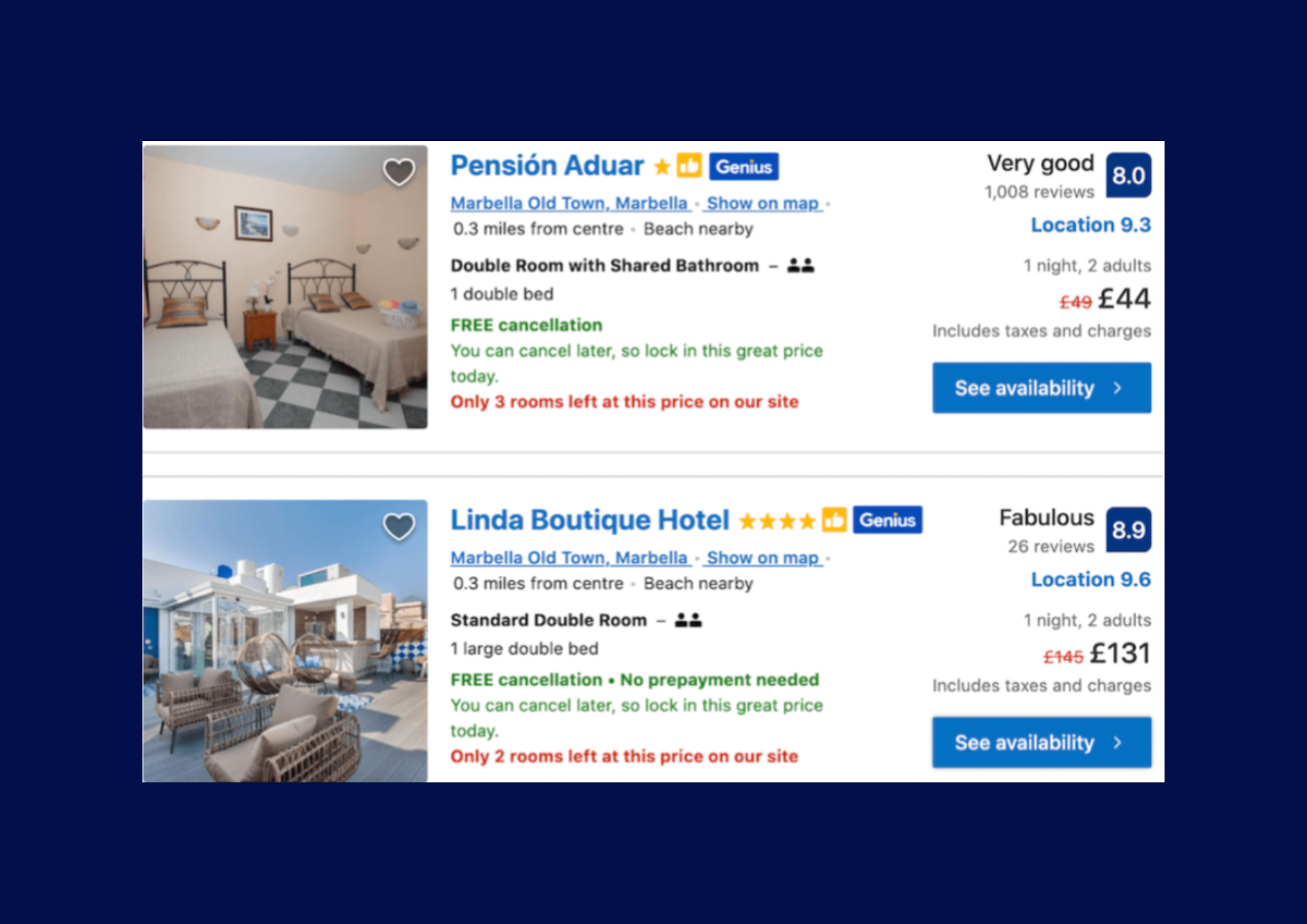

Secondly, scarcity.

We all want what we can’t have. We saw this at the beginning of the pandemic with toilet paper. We’ve seen it with high-end fashion brands and NFTs. As human beings, if we think there is a limited amount of something, we tend to desire it more which encourages the purchase of it.

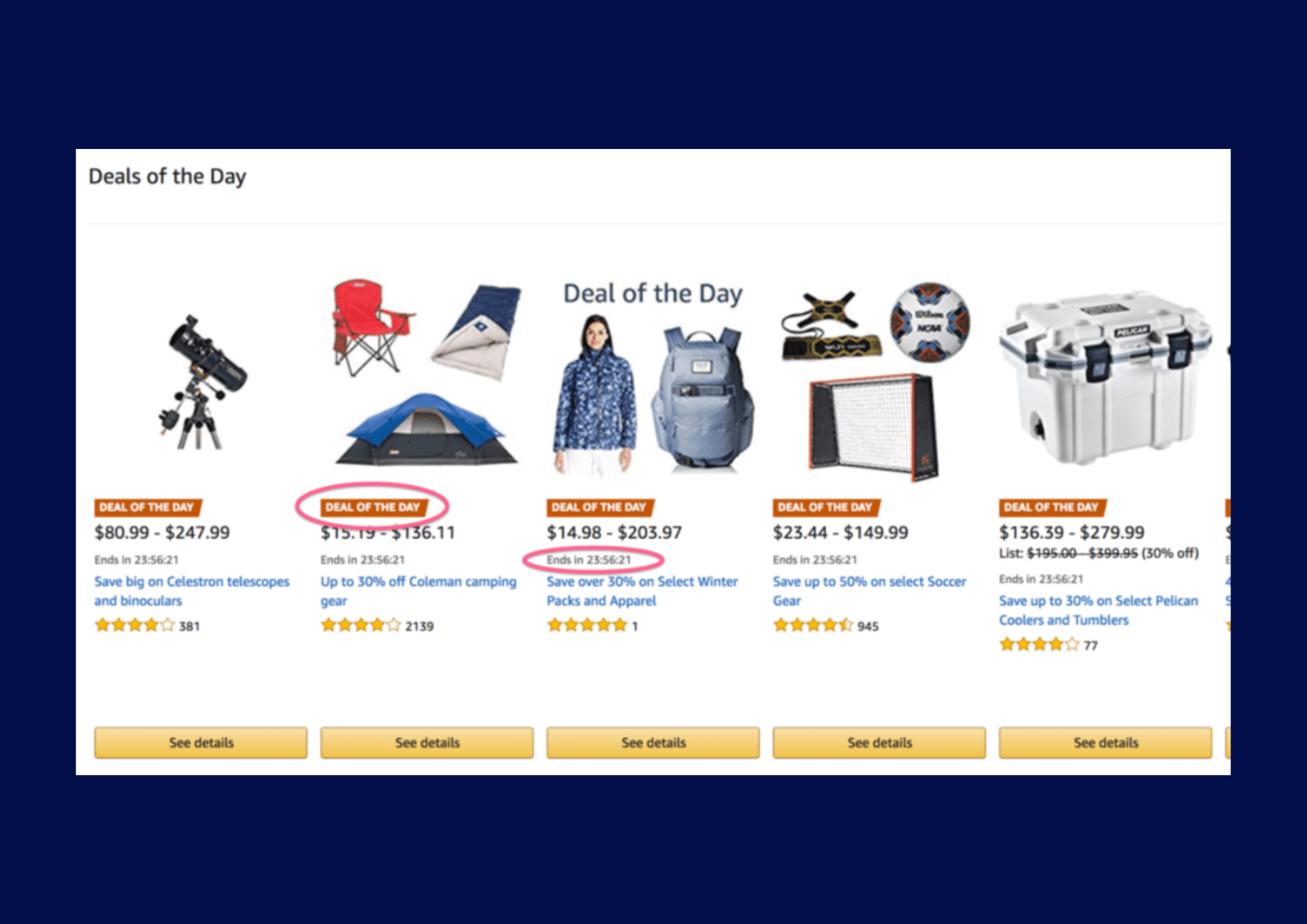

Thirdly, urgency.

By adding a clock and timers to your promotions you’re driving action. If someone knows that a deal will end in a certain amount of time they tend to commit sooner.

Fourth, smaller is better.

When it comes to pricing, smaller is better. As illustrated in the image below, you can see how the picture on the right is more enticing.

Finally, odd-even pricing.

This is a pricing strategy that people use to increase sales, looking at the last digits of the price. For example, if there is an item for £20 and one for £19.99, customers would more quickly buy the second option, even though the difference is just one cent. Customers tend to see it as a lower price than it is. Furthermore, they also tend to trust the purchase more, as the specificity of the price builds trust.

To apply for finance click here.

Follow and subscribe to view more weekly business tips: LinkedIn , Instagram